COMPARING YOUR INVESTING RESULTS

- philmcavoy

- Feb 5, 2024

- 3 min read

SUMMARY:

Your investment results are well below what a VERY GOOD 401K investor produces.

Yet you are also not getting much loss protection from your supposedly “safer” strategy.

Even though the VERY GOOD 401K investor generates higher returns, they also get clobbered in bear market crashes.

Imagine if you could get the better results of the VERY GOOD investor AND keep your money protected from the huge losses associated with stock market collapses?

How would that feel?

NOTE: For your results, I am using the data from a Fidelity Target Date fund that has a 70% allocation to stocks and a 30% allocation to bonds. The long-term return rate of this fund is 6.4% per year. The average 401K investor only generates returns of about 5% per year. I have found that people seeking my help are doing better than average but still underperforming (generating returns of between 6% and 7% per year).

This chart compares the results for the VERY GOOD 401K investor to your results over the last 16 years. I use 16 years because that is the extent of the history for Target Date funds. Your average annual investment gains are around 6.4% (Target Date fund results). A VERY GOOD 401K investor would have posted annual investment returns of 10.4% per year over the same time period. The only difference between you and the VERY GOOD investor is that they make better fund selections. They only invest in US large cap stock index funds.

The investment industry tells you that the lower returns are worth it because the balanced approach is less volatile and that it cushions your losses during bear market crashes. But how does it do as far as limiting your losses?

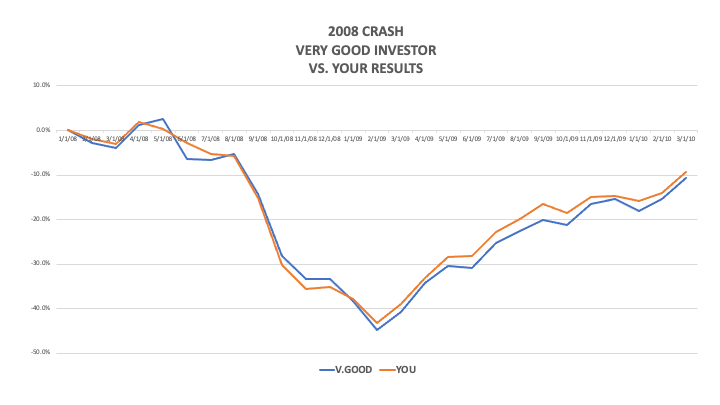

Let’s look at graphs of the last two prolonged bear markets in 2008 and 2022. Here we will compare how a VERY GOOD 401K investor did in those downturns compared to your results (same Target Date fund). The lines look very similar, don’t they? There are just a few months where your losses were slightly less than the VERY GOOD investor. This clearly shows that your balanced and “less risky” approach to investing is significantly lowering the growth of your retirement account and it is providing very little downside protection.

The VERY GOOD investor does get crushed in these bear markets – down about 25% in 2022 and down almost 50% in 2008. These scary declines that come from the Buy & Hold strategy are just awful to live through. Our Beyond Buy & Hold system was developed to address this avoidable pain.

The next two graphs are the same as the previous ones only I have added the grey line which represents what the VERY GOOD investor would have produced if they had used our MARKET SIGNALS system that protects against losses in bear markets. Our MARKET SIGNALS system IS designed to limit losses. By limiting the losses, you end up making more money.

The MARKET SIGNALS investor generates another 2% to 3% per year in average annual investment returns compared to the VERY GOOD investor because they lose less money in downturns. Our system uses the same large cap index funds as the VERY GOOD 401K investor. But MARKET SIGNALS tells you exactly when to get out of the market and exactly when to get back into the market during the scary times.

Because MARKET SIGNALS alerts you when to get out, it dramatically reduces the anxiety associated with stock market investing. You can sleep easy at night knowing that your savings will be protected in the event of a market collapse which can appear at any time and for any reason in the highly irrational stock market.

Click the link to learn more about MARKET SIGNALS and what it can do for your retirement.

Happy Investing,

Phil

Disclaimers The Beyond Buy & Hold newsletter is published and provided for informational and entertainment purposes only. We are not advising, and will not advise you personally, concerning the nature, potential, value, or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. Beyond Buy & Hold recommends you consult a licensed or registered professional before making any investment decision.

Investing in the financial products discussed in the Newsletter involves risk. Trading in such securities can result in immediate and substantial losses of the capital invested. Past performance is not necessarily indicative of future results. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, and market dynamics.

Comments