The earlier you start saving for retirement, the less money it will take as a percentage of your income to achieve your goal. The opposite is also true, unfortunately. The less time you have, the higher percentage of your income you’ll need to contribute to achieve your goal.

This is due to the power of compound interest. The important lesson of compounding is that you should start saving and contributing to your 401(k) as early as possible. There exists an incredible window of opportunity for maximizing the power of 401(k) plans from your early twenties until your late thirties.

Every investor needs to fully understand compounding and how to benefit from its amazing power. This is another one of those things that everyone should learn in high school.

This graph below shows the balance of a 401K where the individual started contributing at age 25 and contributed an equal amount each year. The annual investment return rate or growth rate is also constant. So, the only factor affecting the slope of the line is compounding. Notice how the line start curving straight up after age 50. This is the compound effect.

A 401K investor can affect their retirement account balance the most by starting to make contributions as early as possible – in their 20s or 30s – and by generating higher investment returns through their fund choices. Compounding multiplies the impact of earlier contributions and higher investment returns. This is not the case when you increase the amount that you contribute to your 401K.

I have quantified the comparison of time length, investment returns, and 401K contributions illustrate this point.

Everything else being equal:

A 33% increase in number of years contributed leads to a 103% increase in the account balance at age 65.

A 33% increase in investment returns leads to a 78% increase in the account balance at age 65.

A 33% increase in employee contributions leads to a 33% increase in the account balance at age 65.

Start early and maximize your investment returns to ensure that you have enough money to retire at age 65.

Happy Investing,

Phil

Disclaimers The Beyond Buy & Hold newsletter is published and provided for informational and entertainment purposes only. We are not advising, and will not advise you personally, concerning the nature, potential, value, or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. Beyond Buy & Hold recommends you consult a licensed or registered professional before making any investment decision.

Investing in the financial products discussed in the Newsletter involves risk. Trading in such securities can result in immediate and substantial losses of the capital invested. Past performance is not necessarily indicative of future results. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, and market dynamics.

Updated: Nov 30, 2023

How do you decide which funds to pick for your 401K or IRA account?

Are you confident or comfortable with your fund picks?

Most people do NOT have a disciplined or logical process for their fund selections. Ask ten ordinary investors how they make their picks, and you will get ten different answers. Ask ten investment professionals, and you will also get lots of different answers.

Some people:

Follow the advice of their HR representatives or their 401K administrators.

Are so afraid of losing money that they put their money in bonds and cash.

Are overconfident in their investing abilities and move their money around based upon their own market forecasts.

Follow the advice of financial professionals and spread their money across a variety of different assets – small cap stocks, large cap stocks, international stocks, mutual funds, bonds, and more.

The variety of approaches and the different investment strategies are a clear indicator of how dysfunctional the investment industry is. And none of the approaches listed above will generate enough growth for you to retire comfortably or securely.

With so much data and information available, the fund selection process should be disciplined and consistent. It should be pretty simple and straightforward. And it can be. The investment industry and the financial media make the process much more complicated than it should be.

Put very simply, you should be selecting your investments based on CONSISTENT AND RELIABLE LONG-TERM RESULTS. It should be all about the numbers – about which investments have the best odds of producing the best and most consistent returns in the long run.

It all comes down to what makes one investment better than another. There are only a few factors to consider when comparing investment options.

Expected long-term annual rate of return – the growth rate you can expect from an investment.

The consistency and the predictability of the expected returns.

The risk of losing money in an investment.

How well you understand the particular investment.

The most important statistic to measure any investment is its annual rate of return. For example, a bank savings account that pays 4% per year has an annual rate of return of 4%. For any investment, data is readily available regarding its annual rate of return over various time periods. Notice how I just introduced another factor into the equation – the time period to evaluate.

For investments, unfortunately, people too often look at very recent or short time periods to evaluate performance – for example, six months or the last year. Six-month performance or one-year performance does not tell you much about an investment. Most people will have their retirement accounts for 30 or 40 or 50 years. When you are comparing investment performance, therefore, you want to look at performance over at least 20 years and even 30 or 40 years.

The next factor is consistency. Let’s say two different investments (fund A and fund B) have similar annual returns over the last 20 years – both at around 8% per year. But the fund A achieved those 8% returns much more consistently than fund B. Consistent results are much more reliable when projecting future returns.

The next factor to consider is the risk of losing money. And the most important risk is long-term risk of suffering permanent losses. Most investments carry the risk of short-term losses because all financial markets are volatile. But individual stocks can and do suffer permanent losses when companies go out of business or lose sales to a competitor. Commodities can and do suffer long-term losses when they get replaced by other commodities. 401K and IRA investors should avoid any investments that could suffer long-term or permanent losses.

Let’s now cover the last factor to consider when picking your investments – how well you understand the individual investment. Understanding an investment is not just about knowing what it is, it is also about knowing why it increases or decreases in value.

I am totally convinced that S&P 500 index funds will grow by an average of 9% per year in the future because I believe that their profits will increase at a similar rate. The profits of the companies that make up the S&P 500 have grown by 8.7% per year over the last 50 years. And a 9% increase in profits for any company is not a big number. It is very realistic.

But I have no idea why the price of bitcoin goes up or down and nobody else does either.

When you don’t understand an investment, you do not have any conviction about holding on to that investment. Your buy and sell decisions end up being totally emotional.

Happy Investing,

Phil

Disclaimers The Beyond Buy & Hold newsletter is published and provided for informational and entertainment purposes only. We are not advising, and will not advise you personally, concerning the nature, potential, value, or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. Beyond Buy & Hold recommends you consult a licensed or registered professional before making any investment decision.

Investing in the financial products discussed in the Newsletter involves risk. Trading in such securities can result in immediate and substantial losses of the capital invested. Past performance is not necessarily indicative of future results. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, and market dynamics.

Are you a confident investor?

If you are like most people, you are not.

This lack of confidence comes from a lack of knowledge and a lack of experience.

And it is a big problem for 401K investors. The lack of confidence leads to a lack of patience which, in turn, leads to bad investment decisions.

Through our ongoing training and education, we plan to increase your confidence.

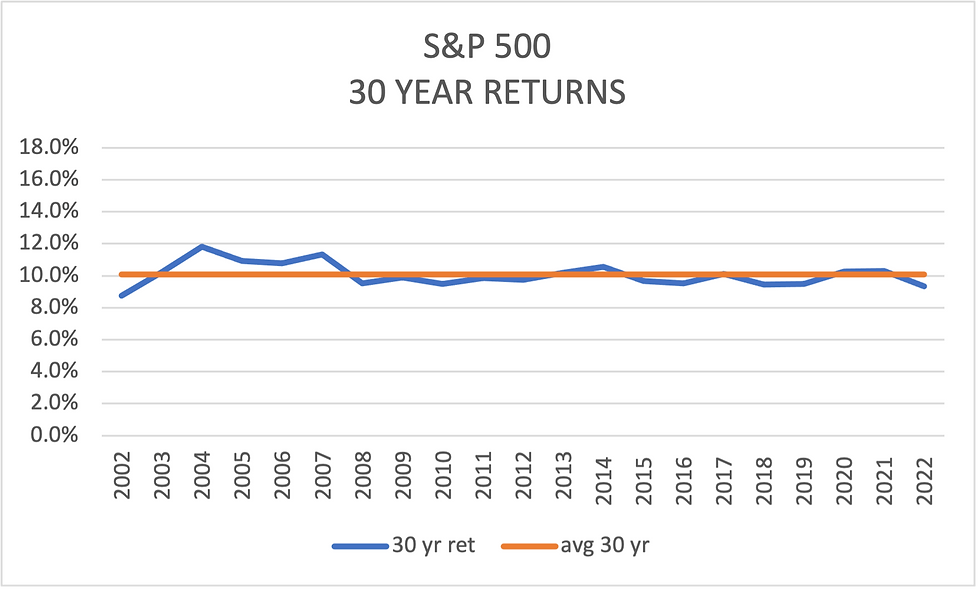

Today, I want to share the chart of the rolling 30-year average annual returns of the S&P 500 starting in 2002 and running through the end of 2022. I would expect that this chart would give you quite a bit of confidence to invest in the S&P 500 index for the long term. Look at the consistency.

The average of all of these rolling 30-year time periods is 10.1%. The lowest 30-year result was 8.8% in 2002 and the highest result was 11.8% in 2004. In most years, the 30-year results were within 0.6% of the average. The line is amazingly consistent.

All investors should be investing for the long term. As a long-term investor, hopefully this chart shows you why I am so confident that you can earn 9% to 10% per year in your 401K. And it is important to note that the time period of this analysis began in 1973. So, it includes the horrible bear markets of the 1973, 2001 and 2008. Like all fifty-year views of the stock market, it includes lots of down time periods and lots of up time periods.

This view of performance highlights one of the many thinking problems for most investors. Most investors overreact to the wild short-term swings of the stock market. This leads to emotional investing decisions which end up being bad investing decisions.

Does this data surprise you? Does it change the way you think about investing your 401K savings?

Happy Investing,

Phil

Disclaimers The Beyond Buy & Hold newsletter is published and provided for informational and entertainment purposes only. We are not advising, and will not advise you personally, concerning the nature, potential, value, or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. Beyond Buy & Hold recommends you consult a licensed or registered professional before making any investment decision.

Investing in the financial products discussed in the Newsletter involves risk. Trading in such securities can result in immediate and substantial losses of the capital invested. Past performance is not necessarily indicative of future results. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, and market dynamics.

%20(1).png)